In a time where customer appreciation and sticking to shipping promises keeps customers returning, utilizing scalable shipping methods is more important than ever

The high expectations that Amazon has set for themselves, and continuously meets, isn’t fooling them into thinking that they’ve made it to the top of the mountain – on the contrary, they understand that with each conquered goal, there will be bigger and higher expectations waiting for them on the next mountain. They have boasted 11 straight quarters of profits, set the bar for convenient shipping and the richest man in the world is their CEO, so what could they possibly have to work on? Keeping up.

E-commerce has continued to skyrocket, not only on direct-from-retail sites, but even more so from online conglomerates like Amazon. By mid-2018 Amazon was already responsible for about 50% of the nation’s e-commerce sales and 5% of all combined offline and online sales. In less than two decades, Amazon has become the online front-runner, and the retail giant has turned the market around – conditioning their customers to expect a free two-day shipping standard during a seven-day work week with deliveries to their home, office or apartment buildings.

“Go to War for the Customers”

“Everything is about the customer, and anything outside of the customer doesn’t matter,” says Dave Bozeman, vice president of Amazon Transportation Services. “We wake up every day, and we go to war for the customers.” He stresses that the two main areas to focus on to keep up with customer expectations are scale and innovation. Currently between 25% and 30% of warehouse space in the country is devoted to e-commerce, and Amazon’s 75 fulfillment centers and over 700 total origin points (including Seller Fulfilled Prime locations) are taking up a large chunk of that. But they need to scale higher, and faster – the quicker a customer’s package is at their door, the quicker they will be back online buying something else.

Amazon was ahead of the curve with their massive investment into warehouses that were geographically dispersed, therefore giving them the opportunity to ship faster to different parts of the nation, which was once viewed as a liability by analysts and brick-and-mortars alike. Amazon now operates dozens of warehouses, fulfillment and sortation centers (which will separate goods destined for different parts of the US), and some of them even exceed one million square feet.

“It’s all about decreasing the distance to the customer to open up last mile options,” states Justin Cramer, Head of Sales & Marketing and co-founder of ProShip. “Walmart achieved this by opening its own fulfillment centers that have enabled them to ship to 98% of the US with ground shipping in under two days. Target on the other hand went a different way completely – their orders shipping within two days are shipping from 1,400 of their 1,800 stores throughout the country,” Cramer adds.

In a recent Forbes article that highlights Ulta, Sephora and the essentials of remarkable retail, contributor Steve Dennis states, “Eschew the boring middle. Most of the retailers that are in trouble are stuck in the middle, neither offering strong value and convenience, nor offering anything unique and truly experiential. Ulta and Sephora knew they could not out-Amazon Amazon, so they chose to be more remarkable in other ways.” Today’s companies don’t have to be exactly like Amazon, they just need to understand their specific customer base in order to build the strategy that keeps them coming back in the war on loyalty.

Face it: Shipping. Impacts. Revenue.

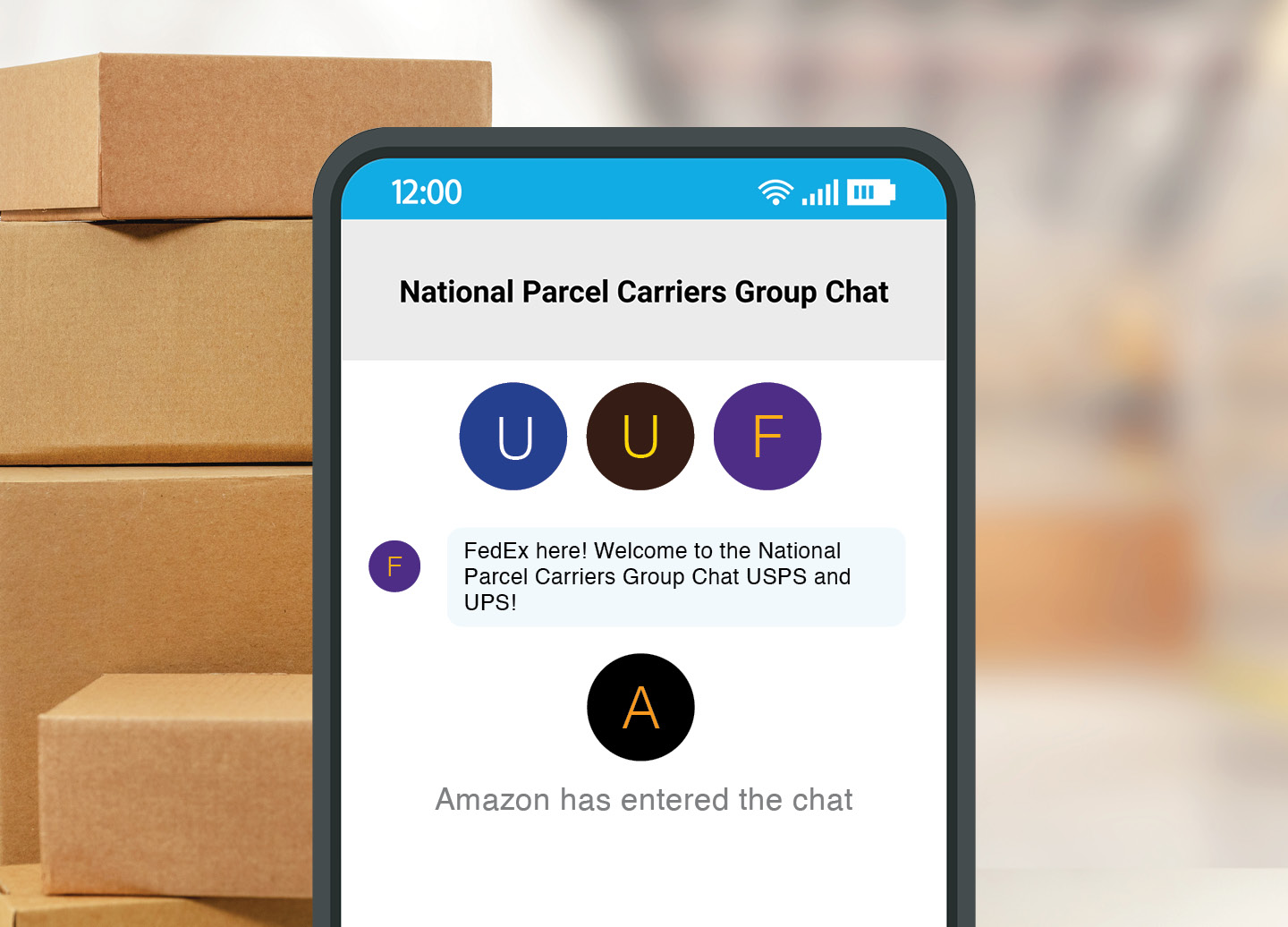

Nowadays Amazon is doing more to take control of their own shipping network in order to cut out the middleman, to reduce costs and expand even faster delivery options for their Prime customers. Currently only about 17% of their packages are not delivered via the USPS, UPS, or FedEx – and Cowen analysts predict that in the next five years that could shoot to 34%. Recent issues with delivery partners, such as strikes, has caused Amazon to rethink leaning on turbulent models and test a number of programs that could replace or at least reduce their reliance on these carriers.

Amazon now has more that 100 million U.S. Prime members who pay monthly and annual fees in exchange for the promise of two-day delivery, according to Consumer Intelligence Research Partners. There is no stated incentive for them to consolidate their orders for more economical shipping, which is why shipping is one of Amazon’s fastest-growing expenses and is consistently outpacing online sales growth. Amazon has to find cheaper ways to deliver packages or will have to continue to hike prices for the membership. Programs that outsource shipping, like Amazon Flex, lets Amazon train the owner once, who then bears the cost of recruiting, training and hiring their own staff.

“Shipping is valuable to Amazon because it’s valuable to Amazon customers, meaning they treat shipping as a competitive advantage in service and experience, not price or operational efficiency,” Matt Mullen, ProShip’s executive vice president and managing director says in USA Today’s 2018 Future of Retail issue. “For example, if we think of Amazon Prime as free two-day shipping for your best customers (how another retailer might see as a business rule), then Prime loses money every time. But if we think of Prime as a competitive advantage in service, it wins. Did you know Amazon’s best customers spend almost double what non-Prime members spend every year? It wins,” Mullen explains.

The growing term “Prime Effect” or “Amazon Effect” has made such a splash in the industry that other retailers are clamoring to stay relevant. Like Target and Walmart, Petco acted on the need for fast shipping by utilizing 150+ stores as fulfillment centers. “ProShip shipping software has allowed us to scale our e-commerce fulfillment network within our DC and ship-from-store network with ease,” states Christopher Fall, Manager of Omni Fulfillment and Supply Chain Optimization at Petco. “The flexibility and speed to rate and service shop multiple carriers instantaneously has allowed us to reliably ship 10’s of thousands of packages daily through multiple channels,” Fall adds.

The supply chain has scaled up and evolved – and it’s all been for the sake of the customer. Choosing technology that scales with the growth of your business is an essential part of success.

Consumers want fast shipping. In the time it takes to say “customer experience,” your window of opportunity can slam shut if you’re using the wrong tools. We like fast. ProShip is the only multi-carrier shipping solution that helps e-commerce leaders ship at lightning speeds, stay carrier compliant 24/7/365 and build stronger-than-ever customer revenue streams. (It’s what we’ve been doing for two decades).

Sources:

- https://www.nytimes.com/2018/06/28/technology/amazon-start-up-delivery-services.html

- https://www.bloomberg.com/news/articles/2018-12-17/forget-drones-amazon-s-jeff-bezos-needs-lots-of-delivery-guys

- https://www.barrons.com/articles/amazon-wants-the-whole-package-in-delivery-1530216320

- https://www.ttnews.com/articles/rise-amazon-logistics

Back to Blog

Back to Blog