Parcel Rate Shopping 101: All the Basics

Hear answers to the most frequently asked questions on rate shopping from ProShip partner, enVista

In the past 2 years, shipping costs have risen more than 23%. Retailers and e-commerce shippers have responded with diversifying their carrier choices and investing in technology to manage these alternatives. A strategy that has proved effective? The optimization of rates via sourcing and rate shopping, which can save companies between 5-15%.

What is Rate Shopping?

Rate shopping in transportation is the process of comparing parcel shipping costs across multiple options to provide optimal service and pricing. The options of shipping a parcel could include different carriers, service levels, and modes.

Why Rate Shop?

Rate shopping allows shippers to meet consumer service commitments at the lowest cost from the carrier and service level options available. Sophisticated systems can compress these complex calculations into a fraction of a second, and these systems can also change dynamically to route packages differently when costs change for the same options.

What can Rate Shopping systems do?

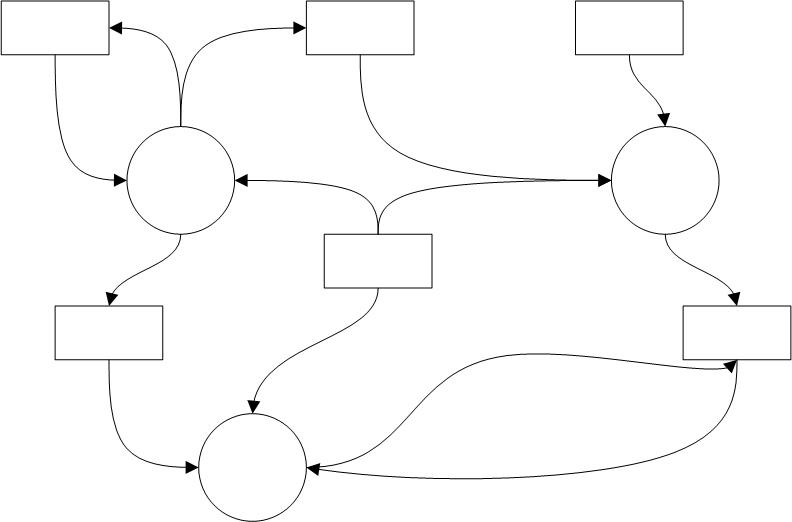

There are different levels of Rate Shopping systems that range from low in complexity (i.e. find the best service) to high in complexity (find the cheapest service that delivers by a fixed date on the calendar (and also considers all other factors that affect that choice)). These systems for rate shopping compare the transportation rates on a weight/zone basis between different carriers and service levels. Typical logic within these systems include:

- Establishing a deliver-by-date

- Finding services that will deliver on or before the deliver-by date

- Picking the lowest cost service to meet the date

What are the complexities of Rate Shopping?

Rating scenarios can range from a simple matrix of costs by weight and distance carried (zone) to complex criteria that require hundreds of data points to rate correctly.

FedEx and UPS have the most complex rating schemas in the industry. What may have started out as simple weight and zone pricing has evolved to include hundreds of fees for anything from size to rurality.

Extra layers of complexity come with most negotiated agreements: revenue-based pricing that increases or decreases incentives with the total business given to the carrier. Even more complexity lies in specialized pricing for specific situations: delivery density pricing programs (hundredweight or multi-weight), customer-built trailers to destination facilities (zone skip), and returns management services. If this were not complicated enough, many of these variables and fees change dynamically based on the fuel market, periods of high shipping demand, and any other pricing changes that these carriers decide to impose at any time.

Requirements for rate shopping software must account for all these variables and shift dynamically to incorporate changes with a weekly frequency. Additionally, they need to adjust quickly not only to market changes (e.g., fuel surcharge), but do it across multiple carriers, and calculate this pricing at scale, in less than a second.

What are helpful parcel Rate Shopping best practices?

Following these best practices will ensure your success with rate shopping:

- Gather & understand all the agreements you have in place with your carriers

- Understand what level of incentives you have on each carrier

- Profile shipping spend for the last 12 months

- Determine what carriers, service levels, weight-breaks, and zones in which you are spending the most money

- Before implementing business rules, create a strategy for monitoring performance

- What are your expectations for savings? How will they be measured?

- What are your expectations for the number of packages to each carrier? What reporting will verify this?

- For complex rules, create new metrics and dashboards you will need to verify your business rules are working

- Post-implementation of new rules, evaluate how metrics line up with expectations

- If not, why?

- After determining any corrections, tweak your business results and repeat

- Monitoring and reporting should include revenue attainment trends towards FedEx and UPS trends, cost per package, use of Express vs. Ground, time in transit, and actualized savings

- NOTE: Be aware and cautious of crossing into a lower tier on revenue-based incentives. This can substantially increase cost!

- Ensure that any rate changes are implemented when packages will be shipped on the updated terms

- This includes the general rate increase (GRI) on UPS and FedEx, US Postal Service increases, or peak surcharges

- At least once a year, evaluate your agreements and carriers.

- Are there new scenarios that would have better transit?

- Are there new business rules that would save money?

- January is an ideal time to do this, to review the last calendar year and peak

Incorporating rate shopping into your program is one of the best means of reducing your costs. In this era, shippers now must adapt to give themselves more alternatives and combat cost increases that are steeper than we have seen for over a decade.

About enVista

For over 20 years, enVista’s consultants have been assisting shippers with strategic initiatives, contract optimization, strategic sourcing, peer benchmarking, strategy road mapping and ad hoc analytics. Once our team has engaged the client, we generally see a level of savings. When we start a ‘rate shopping’ program for our clients it allows their transportation team to understand the true cost to ship packages and move shipping from a short fall event into a profit center. The options of shipping a parcel could include different carriers, service levels, and modes. Let’s explore it in more detail. Find out more about enVista at www.envistacorp.com.

About Mark Taylor

Mark Taylor is the Director of Parcel Consulting at enVista. He has over 20 years of Parcel Industry experience. He works with clients to guide them through contract analysis and negotiation processes. With a background that includes operations, transportation network engineering, new service development, and parcel spend management, he brings a unique perspective to managing parcel programs. His tenure at enVista completes 3 major perspectives in parcel analysis: as a carrier, shipper, and now as a 3rd party consultant. Some of the customers he has worked with include Vera Bradley, Tire Rack, LVMH, AmerisourceBergen, Brooks Brothers, J. Crew and many others. Prior to joining enVista, Taylor was a senior transportation analyst with Lowe’s. He was also at FedEx for a decade including project management and operations engineering roles. Mark has both bachelor’s and master’s degrees in Industrial Engineering from North Carolina State University.