Here’s a closer look at Green Mountain Technology’s 2018 benchmark report

We are living in a world where almost anything can be ordered online and shipped right to your doorstep. Forget the lines during back-to-school shopping or the craziness of Black Friday, companies focused on e-commerce are getting customers their orders much quicker and more conveniently. The Green Mountain Technology (GMT) 2018 Benchmark Report* states that for the third year in a row, parcel is the fastest growing transport mode. With the rise of e-commerce, it’s no surprise that online purchases represented an average of 22% of sales this year among the report’s respondents (versus 8-10% nationally).

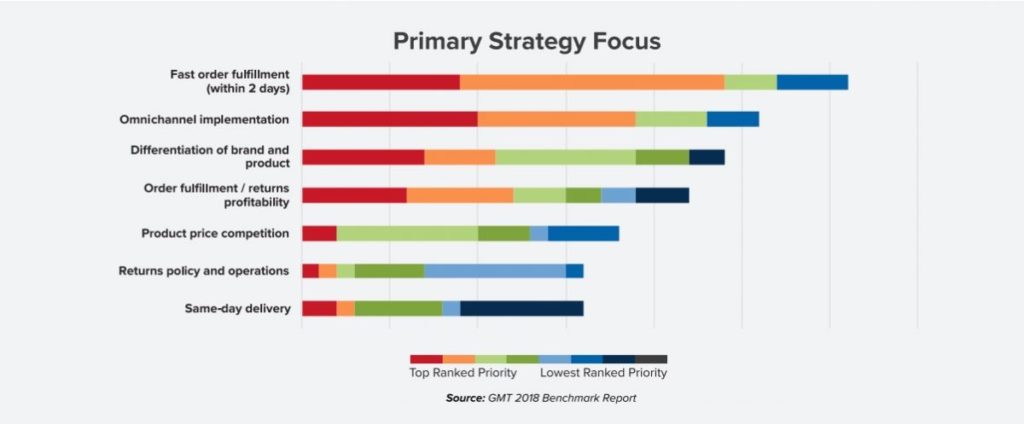

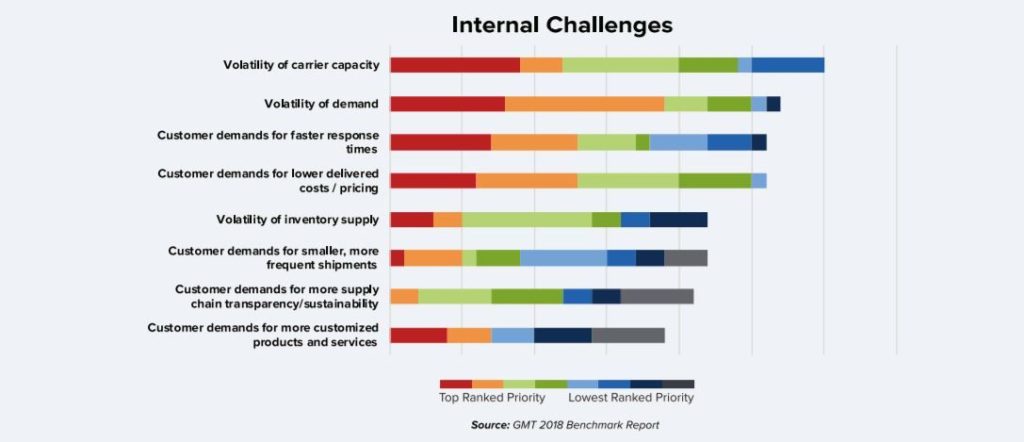

So, what does this mean for your business? Reports have shown that fast order fulfillment, omnichannel development and product differentiation are among the key strategic focuses of shippers around the world. Last mile delivery is even experiencing changes since customers now value convenience when retrieving their packages over price. In fact, 55% of GMT’s respondents expect to add volumes to regional carriers in the near future. Other innovations such as parcel lockers, on-demand delivery and weekend delivery times are all being added to create additional simplicities for the consumer. Younger generations like Gen Z expect the world to move around their schedule and prefer to have options when it comes to parcel retrieval.

The retail sector is a very saturated market – leading to a very competitive environment. When a consumer orders something to be shipped, there are many factors he or she considers, and it is important for the retailer to find a balance between fulfillment speed and profitability. To ensure the optimal customer experience, offer your customers several options such as fast order fulfillment (within two days) and multiple brand options on multiple channels (omnichannel implementation), as these are the key competitive challenges facing shippers surveyed in GMT’s report.

One way that 89% of retailers are relieving expensive shipping costs while giving customers options is offering free shipping through either a minimum order threshold, promotions, or memberships, with a minimum order amount being the most popular. The report also notes that the average minimum order amount that retailers offer free shipping has decreased $7.

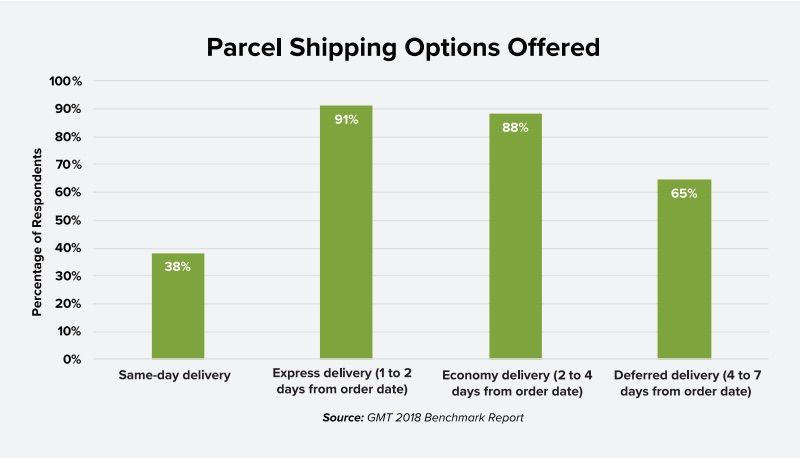

Now that consumers are living in an instant-everything world, retailers and manufacturers are struggling to keep up with customer expectations. Low-cost shipping, timely delivery and no-cost returns are all important factors to keep the customer experience a positive one. The same goes for the shipping experience — consumers want the option to choose their shipping method and control their own cost. Around 90% of businesses offer different shipping options, including express delivery (1-2 days) and economy delivery (2-4 days). This is up 30% over last year, which shows that businesses are noticing what the customer wants and delivering on it.

Amping up shipping speeds and delivering on other customer expectations unfortunately costs the retailer or manufacturer money.Last year only 59% of shippers broke even or made a profit on parcel shipping – this makes it even more important to quickly fulfill orders. With the most common parcel weight being between 1-5 pounds, the average cost of fulfillment was between $4.00 and $8.00. However, shippers cited difficulty with large package surcharges and transport cost inflation in 2017 across all modes (parcel, TL, LTL, intermodal and ocean/air).

In fact, “accessorial charges” is the primary driver of parcel cost inflation in 2017. Green Mountain Technology notes that this is a departure from past benchmarks, which showed base freight increases as the primary driver. They also declare that the best strategy to mitigate price increases is changing the service mix followed by a contract management event.

Regarding carriers, last year more than 80% of consumers reported using either (or both) FedEx and UPS – and both regional carriers are expected to continue with an upward trend in the forthcoming years. Fully integrated and automated shipping solutions approaches carriers with an agnostic view, to choose the best option for price and timeliness, not by popularity. From customers to carriers to distribution channels, a smart shipping solution must streamline, standardize and simplify complex customer interactions and logistics. Think about multi-carrier solutions that function worldwide and enable businesses to be proactive and profitable.

Now is the time to balance customer experience with efficiency and cost savings. Studies are now showing that consumers want fast order fulfillment, different options and omnichannel implementation. By putting the right shipping software to work, you are able to work smarter and faster, while serving your customers better. Your customers will thank you for it.

The Benchmark included responses from shippers across consumer/retail and industrial end markets, and were relatively evenly split between retailer/distributors and vendors/manufacturers. 70% of respondents had annual revenues of at least $1.5 billion, and e-commerce sales represented 22% of average sales for 43 total responses. Nationally, e-commerce sales represent 8-10% of sales.

Back to Blog

Back to Blog