[International Shipping Documentation] Parts of a Commercial Invoice

Learn about the important information included in a commercial invoice, and why it must be accurate

Finding a way to grow your business within just the United States can feel limiting. Many brands are looking beyond US borders to bolster both their customer base and bottom line. And with the growth of e-commerce, customers themselves are looking both far and wide for products – no longer limited by just their own country.

With nearly $8 billion dollars’ worth of opportunity by 2031 (the expected cross-border B2C e-commerce market), can businesses really justify not taking this leap? For those ready to take the dive, it’s important to note that any global brand could tell you that international shipping is not all easy. It comes with its own share of headaches, especially in the form of additional documents and forms needed for each shipment.

Today, we are breaking down one of the required documents for shipping cross-border: a Commercial Invoice. This document is used to get products cleared through customs in the country of import and is a detailed record of a transaction between buyer and seller used by customs agencies to clear shipments and calculate applicable duties and taxes. Note that commercial invoices are only necessary for shipments across international borders, so they are not necessary for shipments between 2 states, for example, from California to Wisconsin. They are also not necessary when countries that are members of the European Union (EU) are shipping to each other since they are part of the same economic union.

Required Information for a Commercial Invoice

Once a Commercial Invoice is filled out accurately and completely, shippers can avoid any delays at Customs or delivery of the shipment.

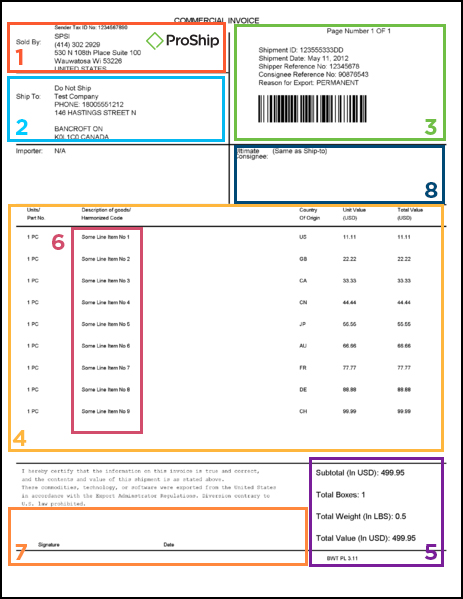

Here is a breakout of the 8 areas of required information found on a commercial invoice. Please note: the numbers on the color coded invoice correlate to the numbered list of information described below.

1. Seller Information

The first section of every commercial invoice should include seller information. The seller is the exporter, or where the shipment originated. This can also be referred to as the “shipper”.

Contact information required for the seller includes:

- Name (Business)

- Business logo

- Street address

- Phone number

- Postal code

- City

- Country

- Tax identification number

2. Buyer Information

The next section will include the buyer information. The buyer is the importer, or where the shipment is being delivered. This can also be referred to as the “consignee”.

Contact information required for the seller includes:

- Name (Customer)

- Street address

- Phone number

- Postal code

- City

- Country

- Tax identification number

3. Reference Information

Every invoice is tracked by reference information to differentiate it from other shipments. This can include reference numbers, dates, and additional information including:

Every invoice is tracked by reference information to differentiate it from other shipments. This can include reference numbers, dates, and additional information including:

- Shipment ID

- Shipment Date

- Shipper/Seller/Exporter Reference Number

- Consignee/Buyer/Importer Reference Number

- Reason for Export (Temporary, Permanent, etc.)

4. Product and Shipping Details

One of the most important pieces of information on a commercial invoice is the itemized list of products that are included with this shipment. This will offer the customs department a detailed and complete list of the contents of the shipment and their prices. Information that must be included:

- Quantity of units

- Part number/Name of product/Brief Description

- Country of Origin

- Value/Price per Piece (must specify currency)

- Total Value/Price Per Line of Product (must specify currency)

5. Totals

This section totals the values and weights from the previous section. You should have the following information:

- Subtotal (must specify currency)

- Total number of box(es)

- Total weight of box(es) Note: the weight of the box is considered packaging weight and typically excluded from the net weight.

- Total value for total number of box(es)

6. Harmonized System (HS) Codes

In addition to product descriptions, every product should include a Harmonized System (HS) code. This system was created to categorize merchandise based on type, purpose, and nature so the customs department can apply taxes, tariffs, and other duties to each product line.

7. Authorized Signature

For the shipment to be approved and the document finalized, the Shipper/Seller/Exporter should sign and date the document. Printed name and place of issue are also occasionally included.

8. Other Related Information

If it is necessary to communicate contract terms and payment information for the shipment, payment terms and terms of sale will be included on the commercial invoice. This payment information will include:

- Which party takes charge of shipping, insurance, and customs costs?

- Who is liable for the goods at every step of the delivery [Incoterms]?

Other Important Tips for Commercial Invoices

An important distinction is that not all commercial invoices will look the same. While each one will note the required information, it may be spread out differently on each document or formatted in a different way.

This information can seem staggering for many, and legal documentation changes doesn’t make it any easier. For example, there is a change coming for inbound air shipments to the EU. As of March 1, 2023, all goods shipping to or through the European Union (including Northern Ireland, Norway and Switzerland) will be required to submit additional information including the minimum six-digit Harmonized System (HS) code for each item in the shipment, full and accurate goods description, and the receiver’s Economic Operator Registration and Identification (EORI) number on the commercial invoice.

While all this of this information can seem overwhelming, many shipping carriers can provide a template for you to fill in as needed. In addition, an advanced multi-carrier shipping solution, can generate documents like the commercial invoice, USMCA, Certificate of Origin and more. When you are shipping thousands (if not millions!) of packages a day, it can be difficult to manage cross-border parcel documentation to ensure the timely delivery of your packages. Complexities like dangerous goods or LTL shipments don’t complicate the process with the help of an elite solution. Most major international carriers offer a way to generate and transmit documentation electronically so that appropriate documentation is systematically identified and included to simplify a shipment, whether domestic or cross-border.

How ProShip Multi-Carrier Shipping Software Can Support Your Cross-Border Shipping Program

If you are looking for a partner to support your cross-border shipping program, look no further than ProShip. ProShip’s industry-leading shipping software has a broad library of international carriers and supports the exchange of documentation to maintain compliance and avoid delays. Our expert team has the experience and the knowledge to help manage your transportation spend to lower your shipping costs, streamline shipping processes and workflows from label to delivery, and seamlessly execute and automate shipping decisions in just milliseconds.