Hear from a panel of ProShip shipping experts on what to expect in the coming months across the supply chain industry.

With a tumultuous peak season ahead, many shippers are wishing for a magic eight ball to ask burning questions on what they can expect. Peak season came early last year, and there was no way that shippers could have predicted it. But the artificial peak brought on by the pandemic has continued and surged forward with unplanned capacity levels and disruption throughout the supply chain landscape.

ProShip Expert Opinions on Shipping Parcel at Peak

So what can we expect next? We sat down with our own panel of shipping experts at ProShip to find out what they see on the horizon for peak season with carriers, shippers, and capacity. (Profiles for all our experts are included at the end of the questions.)

Question: Our last opinion panel centered around Amazon’s parcel and logistics operation. Do you see any changes in their strategy or new direction for where they are headed next?

ProShip Panel: Amazon continues to roll out technologies such as APIs that make it easier for sellers to partner with them for marketing and distribution and act as a small parcel carrier for any shipments not originated on the Amazon platform. This increases Amazon’s already gigantic footprint in e-commerce and ultimately drives delivery business away from the common parcel carriers. Another thing to note is the technical limitations they have had with label printing. It will be difficult for them to continue gaining market share if their technology isn’t compatible with customers who use conveyor systems.

Question: Many e-commerce brands and retailers are set in their “comfortable” single-carrier strategy with only national carriers. How can shippers convince them to add in regional carriers?

ProShip Panel: All the experts agree – look at last year’s challenges. Shippers should recognize that a single-carrier sourcing strategy is one of the most dangerous approaches to take in today’s environment. The national carriers are leveraging the current situation to increase prices, leaving little room for shippers to negotiate rates or favorable terms regardless of volumes. Single carrier strategies used to allow for consolidation of volume for better rates, that isn’t working now. With current estimates between 4.7 and 5 million package per day deficit expected during the 2021 peak, shippers are susceptible to capacity constraints, service disruptions, and higher transportation costs. Shippers should frequently evaluate their carrier partnership portfolio and looks for opportunities to diversify their exposure. Furthermore, there is no guarantee that there will still not be a multi-million package per day deficit in 2022. [Single-Carrier Parcel Shipping Strategies are Dead. Here’s Why]

Question: Is there a cost that comes with carrier diversification? Any drawbacks?

ProShip Panel: Yes – any innovation comes with a cost. The cost includes additional carrier(s) for your logistics/operations teams to manage and the onboarding for those carriers, not to mention the time necessary to understand and make the proper decisions utilizing any software upgrades or any operational barriers like floor space or dock accommodations. So overall, there is a cost in terms of additional complexity and investment. But, by putting standard operating procedures and automation in place, the result of diversifying should more than outweigh the initial implementation costs. At the end of the day, the question remains: is it worth the risk not to diversify?

Question: How are the more established carriers adjusting to the influx of new carriers?

ProShip Panel: It appears that the established carriers are changing their strategy from a focus on residential delivery to sectors that have been more profitable for them, such as healthcare, B2B, and SMBs. As new carriers come into the market, including crowd-sourced services, and as retailers implement distributed fulfillment strategies like BOPIS or Ship-from-Store, it will drive down the profit potential for all carriers.

Question: Have you seen carriers adapt or make specific changes after the 2020 peak season? Were they successful?

ProShip Panel: We all know the biggest change the carriers have made is to impose and increase “demand” surcharges. This has been successful for them as attested to by their recent financial results. Transportation is currently a strong seller’s market, which makes the environment tough for the buyers, aka the shippers. In addition, many carriers have expanded capacity as fast as physically capable to take advantage of the increased volume. However, carriers are also actively renewing contracts to incentivize profitable packages, making the volume discounts of old a difficult thing to achieve.

With respect to the smaller carriers, there is a trend starting of consolidating effort in order to keep up with the large capacity carrier year-round. The smaller carriers are consolidating their network to extend their reach beyond their current regional constraints.

Question: As far as service level expectations, are carriers delivering on their promises? Are they still overwhelmed?

ProShip Panel: While a recent survey has shown that overall, on-time performance is the biggest complaint for only 18% of shippers, on-time service performance ratings went down for FedEx, UPS, and the USPS from 2020 to 2021. All carriers are still having problems getting back to 2019 on-time delivery scores – though some are handling it marginally better than others. In theory, they should be better prepared after last peak season, but it is possible that we will see echoes of what happened last year.

Question: With many carriers announcing that they are no longer accepting new business for 2021, what can shippers still do, if anything?

ProShip Panel: We talk every year about the need for shippers to plan early, especially when it comes to peak season. But this year, the timeline has once again moved up earlier in the calendar year. By now, shippers should already have planned their selling and distribution strategies for the peak holiday season and be executing on those plans. It may be too late to add new carriers to the portfolio. However, it is still possible to change the mix of carriers that are used each day. The regionals may have partnerships which can help move parcels outside of their delivery networks. Ideally, a well-implemented system allows for that kind of change dynamically- with no disruption to operations. Finally, it’s important to note that the United States Post Office will take all packages, though delivery times are expected to lengthen as packages flood USPS’s network.

Question: How does a carrier’s overall brand reputation fit into the customer experience?

ProShip Panel: In this decade, we are entering into a new paradigm where the carrier’s brand does not carry as much weight as it did in the past. New business models and technologies are flattening the brand curve. Your package was delivered today by someone who signed up to drive a van for Amazon last month. Your dinner will be delivered by a neighborhood mom in her ten-year-old four-door sedan. Both will get there with relevant delivery alerts along their journey. The next generation is accepting of a world where their items appear on their doorstep, and they do not really care who put it there.

Question: Does 2021 offer an environment conducive to implementing any different strategies for managing the coming capacity constraints?

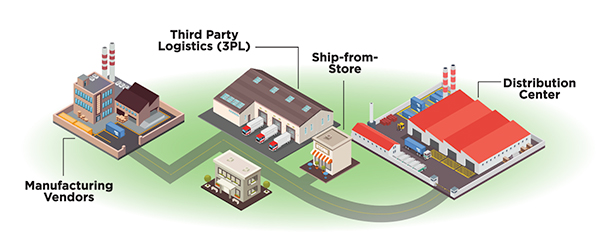

ProShip Panel: As far as the global supply chain, 2021 is just a continuation of 2020, and the same phenomena will likely push into 2022. The greatest strategy for parcel shippers to adopt in the short term is to source from multiple carriers and implement procedures and systems to optimize the capacity they have available. The longer the effects of the pandemic drag on, the more likely it is that shippers can make long-term changes, such as changing their distribution model to leverage alternative shipping origin points, including vendors and 3PLs.

Question: Are there any carriers that shippers should look to be able to find capacity that they may not have considered prior to 2021? Any success stories and has that relief been meaningful?

ProShip Panel: Even the regionals have had trouble keeping up with demand, but they are expanding to keep up with that demand.

Another key to remember is strategies outside of your location. Even though a shipper may not have a facility located in a carrier’s coverage area, they can still partner with that carrier through zone skipping. With zone skipping, shippers line-haul a load of packages to the carrier’s hub for final distribution by that carrier in their serviced region. [How Zone Skipping Can Transform Your Parcel Fulfillment Strategy]

Question: With increased volumes in e-commerce parcel shipping, what can shippers do to level the playing field for other industries regarding capacity? (Pharma, healthcare, etc.)

ProShip Panel: In the daily operation of their networks and imposition of demand surcharges, the carriers do not distinguish between industry sectors. The carriers do make the distinction when it comes to negotiating rates and onboarding new volumes. Every shipper should know their shipping profile well – in terms of their average daily volumes, profitability, service mix, and package characteristics. A shipper distributing heavy and urgent healthcare products to commercial addresses will have much more negotiating leverage than an e-tailer shipping lightweight consumer goods through postal last-mile services. Also, remember that negotiating occurs on more points than just base rates, such as pickup times and carrier ancillary services.

Although e-commerce is likely to hold the lion’s share of capacity for the foreseeable future, shippers can look to value-add services to help make up the difference. White glove services and cold chain are ways non-e-commerce shippers could gain an edge. UPS Premier is a good recent example of this.

Question: Have you seen shippers adapt or make specific changes after the 2020 peak season? Were they successful?

ProShip Panel: The number one request ProShip has received in the last year and a half is to enable more of our certified carrier engines in our customers’ solutions. Shippers are also successfully changing the balance of carrier services that they use to distribute orders and are making the ability to change that balance more configurable. Besides that, shippers are pushing their sales promotions earlier in the year than usual, enabling shipping from alternative origin points like stores and 3PLs, multi-shoring their production operations, and using Ship-from-Store when applicable.

Question: The pandemic pushed omnichannel fulfillment strategies like BOPIS, curbside pickup, and ship-from-store to shippers. Are these strategies still being used? How can they be optimized in 2021?

ProShip Panel: Smart sellers were already implementing these strategies prior to the pandemic, and they are all still being used. We continue to see sellers rolling out these strategies, just with greater urgency. Implementation requires thoughtful planning and the right partners and technologies to not only execute but also to measure impact for continuous improvement measures.

Agree/Disagree & explain. Peak season will mean more demand, less capacity, and higher prices.

ProShip Panel: Absolutely agree. The age-old forces of supply and demand are in play in the supply chain and will continue to be for many months. It’s already been mentioned that demand will most likely exceed capacity, and it’s well-know that carriers are implementing peak surcharges for 2021. In addition, “Peak” has not ended from last year for some shippers. Demand is still high, and capacity is still very constrained for many.

Question: With customers expecting the same fast shipping regardless of peak season, how can shippers anticipate or manage to meet these expectations?

ProShip Panel: Sellers need to be upfront with consumers from cart to delivery. If items are on backorder or could arrive late, the consumer needs to know this upfront and be hyper-informed of the status. Everyone is aware of the challenges at hand, but good customer care in the face of those challenges will separate the winners from the losers. More than ever, end-to-end visibility is key to maintaining favorable customer reviews. For those in the supply chain: diversify, diversify, diversify… is what was recommended 6 months ago. It may be too little, too late for any shippers who haven’t already engaged or onboarded with other carriers, but it can’t hurt to look. Worst-case scenario, you prepare yourself for 2022.

Question: If you had to address surcharges or accessorial fees for 2021 peak, which would you warn shippers about?

ProShip Panel: Oversize or additional handling fees: With capacity already at limits, it wouldn’t be surprising if carriers look closely at parcels that exceed a service’s physical limits. Perhaps lesser known but just as impactful: data correction fees. Some carriers can and will assess charges for missing/invalid manifest data or other compliance issues. It is critical to stay within compliance if you want to avoid those fees.

Shippers should be particularly aware of surcharges that are based on volume. They should be aware of what their thresholds are and when they will cross them. For example, the demand surcharge on a UPS SurePost package is $1.15 once volume is 110% to 200% of February 2020 volumes, but it goes up by a dollar once the shipper reaches the 200% threshold and an additional dollar for every 100 percentage point increase beyond that. Shippers cannot be blind to where they stand in relation to these surcharges at any point.

Question: What lasting effects have changes in the customer experience had on the supply chain?

ProShip Panel: Customers expect more in terms of options and visibility. They want to be able to order whatever they want using whatever device they have at hand, know what options they have for receiving it, and when it will get there with notifications at every point. The pandemic has accelerated e-tailers’ actions to bring innovations to market, and that in turn drives customer expectations higher. For retailers to promote a positive customer experience, it will require the right technological investments with regular check-ins to measure effectiveness. [ProShip multi-carrier shipping software for Retailers]

Question: Consumer behavior has been somewhat erratic over the past year and half, making forecasting using historical data difficult. What can shippers do to accommodate these knowledge gaps?

ProShip Panel: For years, many aspects of the supply chain have just worked reliably with little disruption or need for drastic change, but all of that has been upended. When the demand and supply chain pictures are difficult to forecast, then shippers should remain flexible. They should have distribution models in place that can accommodate sudden changes in the situation on the ground and the systems that allow them to execute on those changes at a moment’s notice.

Moreover, incorporate analytics and business intelligence into logistics operations. There is a wealth of data available that many shippers are either ignoring or not taking full advantage of.

Question: Are there any changes that shippers should make to their Enterprise Software Stack (ESS)?

ProShip Panel: It may be too late to make significant changes for peak 2021, such as implementing a new Order Management System. Many larger businesses will go into system or code freeze in the next several weeks. But businesses should have in place the ability to source orders from any available inventory source and to deliver them via any of their carrier services in the most efficient mix possible with maximum adaptability as we move into Q4. The important thing is to prepare to handle the additional volume. Whether that means spinning up new servers or new application instances to increase throughput, it’s best to be prepared than scrambling during peak.

Question: Are there any recent supply chain or logistics technological innovations that should be highlighted as cutting-edge in 2021?

ProShip Panel: The use of advanced tracking sensors in packages is exciting. The technology has been around for years, but the release of services like UPS Premier that take advantage of it shows promise for new levels of visibility parcel distribution. In addition, robotics in revamping warehouses for better utilization of space is always coming out with additional innovations.

Question: Are green logistics and eco-friendly initiatives still a focus in 2021? What are the most important sustainability factors to consider?

ProShip Panel: While some think sustainability may have taken a back seat given the challenges shippers and carriers have faced in the last year-and-a-half, it is a growing focus. A 2021 survey of supply chain professionals found that 23% believed environmental sustainability is a current concern, but that 37% believed it would be a concern in two years. There is growing public pressure for businesses to reduce their carbon footprint, and delivery is one of the target areas. An efficient supply chain is a green supply chain.

ProShip Tips for a Successful Peak Season

Carrier Diversification

The experts made it clear that diversifying your carrier strategy is the baseline for combating capacity constraints and increased carrier surcharges. With a simple onboarding process, you can onboard the global, national, regional, and any other carriers necessary to ensure a successful peak season. [Learn more: Top 4 Myths About Carrier Diversification]

Increased Productivity

When your business runs on carrier engines that are built in-house, you don’t need to worry about the increased throughput of the busy holiday season. With some retailers shipping millions of packages in a single day, the proof is in the pudding – no downtime and no delays. [Keep reading: The Hidden Costs of Parcel Shipping System Downtime]

Omnichannel Initiatives

When you have inventory sources all over the country, utilizing the closest source to the customer will not only shorten the time in transit – making your customer happy, but it will keep your transportation costs down – making everyone happy. Software that works with the rest of your Enterprise Software Stack (ESS) flawlessly makes these kinds of shipments possible and can even automate the decision. [Explore further: GNC and ProShip | An Omnichannel Fulfillment Story]

Elasticity

With a unique business product, you get unique business solutions. With the current industry landscape pushing the complexity to the brim, flexibility and elasticity is essential to be able to scale and adapt to the capacity and dynamic business decisions that will no doubt be mandatory during peak season. [Listen in: Carrier Concerns: Budgeting, Capacity, & Contracts]

While we can’t see exactly what the 2021 peak season will look like, the experts agree that we should prepare for limited capacity and stretched shipping budgets. With a multi-carrier solution in place, shippers can feel secure that they will be able to navigate another busy peak season with a reliable and elite shipping strategy in place.

Panel Bios:

Bill Schroeder is President of ProShip, where he is focused on innovation to enable ProShip to continue delivering seamless, industry-leading solutions to our customers. His depth of experience in supply chain and technologies provides immense value to our customer base that spans the globe. Prior to ProShip, Bill spent 20 years in logistics technology with FedEx, where he focused on innovation and optimization of technology processes.

Clint Boaz is Senior Sales Engineer for ProShip, where he leverages his expertise to show shippers how integrated multi-carrier shipping solutions can bring efficiencies to their business. Prior to joining ProShip, Clint held various roles at UPS. Clint lives in Tulsa, Oklahoma with his wife and three children.

Dan Scott is the Manager of Research & Development at ProShip, where he guides and facilitates the day-to-day activities of the ProShip development team to help deliver value to ProShip’s customer base. He has been with ProShip for several years primarily as a software developer before attaining his current position. He currently resides in Wisconsin.

Joe Lowrey is the Team Lead for the Customer Success Specialist team at ProShip, where he leverages his industry experience and product knowledge to help enterprise-level customers improve upon their shipping platforms to stay ahead of industry trends. Prior to ProShip, Joe spent 13 years with C.H. Robinson. He lives in the Milwaukee area with his wife and three children.

Justin Cramer is Co-Founder of ProShip, where he has deployed, designed or consulted on over 300 customer solutions within 4 continents and has designed shipping solutions executing more than 1.1 million labels a day. Justin has been on the IT side of shipping since 2001.

Mike Stoessel is an experienced Enterprise Sales Executive at ProShip with a strong history of working in the software industry. He’s been in the supply chain information technology space for over 20 years as a dedicated proponent of shipping and logistics solutions.

Back to Blog

Back to Blog